JABALPUR

Friday, August 30, 2013

Saturday 31 August 2013

The Policies that failed

{Editorial

Postal Crusader September, 2013}

In the

year 1991 when the New Economic Policy or the Neo-liberal Economic Policy was

adopted by the then Narasimha Rao Government at the Centre with much fanfare,

it was repeatedly declared that it is a panacea for all the crisis faced by the

Indian economy and shall ensure rapid growth of Gross Domestic Product

(GDP). After 22 years, it is the very

same neo-liberal policies which is leading the country to an economic

disaster. The then Finance Minister Sri.

Manmohan Singh had brush aside the criticism and opposition of left parties and

trade unions and they became a target of concentrated attack by the supporters

of the neo-liberal policies. Inspite of

stiff resistance from all trade unions the Government went ahead with the

rigourous implementation of the anti-people, anti-labour policies of

Liberalisation, Privatisation and Globalisation (LPG).

While the

UPA Government desperately wooed foreign capital and handed out concessions to

big business and corporates, the plight of the people has been worsening

because of the economic slowdown, falling industrial production and high

inflation. The rupee has steadily

depreciated in value, with the exchange rate of the rupee to the dollar

breaching the Rs.68 mark last week. The

current account deficit (the gap between exports and imports and other

remittances) has reached an unsustainable level, there is rising external debt

with the bourgeoning short-term debt, posing immediate problem. This financial crisis is accompanied by high

inflation. The fact that the creation of

two India’s of the rich and the poor, with the gap between them widening

alarmingly, is a reality that stares us every moment.

The first

UPA Government was not allowed to implement the reforms in the financial

sector, pension sector and retail sector etc. by the left parties who supported

the Government. It prevented the passing

of PFRDA Bill by threatening to withdraw support to the Government. The second UPA Government without the left

support, started rigourous implementation of the reforms in all sectors. All barriers for the inflow of foreign

capital to the country was removed and the cap of Foreign Direct investment

(FDI) in banking, insurance, pension, retail, defence, telecom etc. are either

enhanced or removed. Large scale

disinvestment of public sector has become the order of the day. Deregulation of petrol pricing has resulted

in everincreasing prices of petrol and diesel fuelling inflation which resulted

in the increased burden of price rise for the people. Onions,vegetables and all other necessities

of life are becoming out of reach of the people. The other outcome of the economic slowdown is

the loss of jobs in the industrial and services sectors and rising

unemployment.

The UPA

Government is seeking to overcome this crisis by attracting more foreign

capital and giving more concessions to the multinational companies (MNCs) and

Indian big business. The growing

dependence on foreign capital flows and FDI has worsened the situation further

and the entire exercise has proved futile.

The bulk of the capital flows out of the country is from equity, debt

markets and Foreign Institutional Investments (FIIs), which the Government

cannot control. The neo-liberal policies

of the Manmohan Singh Government and the boosting of the economy through

Foreign Capital inflows have now come to roost.

During the

last three years at least, the tax concessions provided to the corporartes and

the rich amount to, according to budget papers, to over five lakhs crores every

year. Despite such “incentives”, the

overall growth of the industrial production was minus 1.6 per cent in May

2013. If, instead, these legitimate

taxes were collected and used for public investments to build over much needed

infrastructure, this would have generated large-scale employment. This, inturn, would increase the purchasing

power of the people and vastly enlarge domestic demand. This would lay the basis for a turn around in

manufacturing and industrial production and put the economy on a more

sustainable and relatively pro-people growth tragectory.

What the

country needs is an alternative pro-people policies. Such an alternative can be brought about

through the intensification of popular struggle of the people and working class

in the coming months.

Thursday, August 29, 2013

PFRDA BILL LIKELY TO BE TAKEN UP IN PARLIAMENT ON 2nd SEPTEMBER 2013. ORGANISE TWO HOUR WALK OUT AND NATIONWIDE PROTEST DEMONSTRATIONS

It is reported that PFRDA Bill

will be take up in Parliament for discussion and adoption on 2nd September.

Confederation National Secretariat once again calls upon all Central Government

Employees to organize 2 hour walkout and nationwide protest demonstration on

the day if bill is taken up or on the next day if information received late.

(M. Krishnan)

Secretary General

Confederation

Wednesday, August 28, 2013

Thursday 29 August 2013

Promotion and postings of Senior Administrative Grade (SAG) Officers

of Indian Postal Service, Group 'A' to Higher Administrative Grade (HAG) of the

service and transfers/ postings of regular HAG Officers of Indian Postal

Service, Group 'A'(Click

link below for details)

Transfers and posting of Sr. Managers and Managers of Mail Motor Service (MMS), Group 'A' of Department of Posts (Click the link below for details) http://www.indiapost.gov.in/DOP/Pdf/Postings/6_3_2013_SPGdtd23aug2013.PDF

Tuesday, August 27, 2013

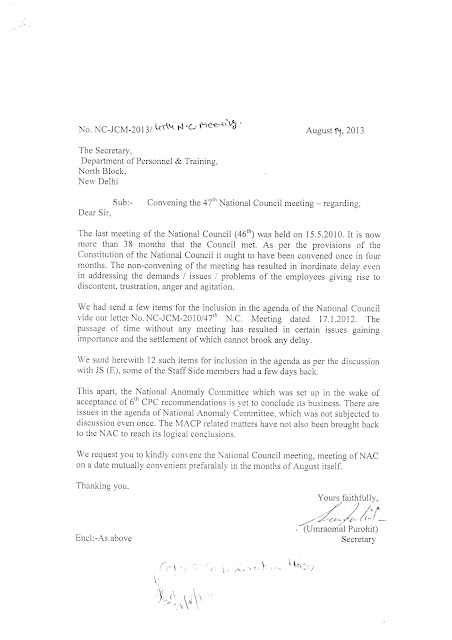

CONFEDERATION DEMANDS INCLUDED IN THE AGENDA OF THE JCM NATIONAL COUNCIL

Agenda for next meeting of the

JCM National Council has been finalized on 27.08.2013 in consultation with

DOP&T Twelve demands raised by Confederation in the charter of demands are

included. (including GDS employees demand) Next meeting of National Council JCM

is expected by the end of October 2013.

The letter give by Com. Umraomal Purohit, Secretary, JCM

(NC) and the 12 demands included in the agenda are given below:

M. Krishnan

Secretary General

Confederation

Monday, August 26, 2013

Tuesday 27 August 2013

Friday, August 23, 2013

Thursday, August 22, 2013

MINISTRY OF PERSONNEL, PUBLIC GRIEVANCES & PENSIONS

LAUNCHES RTI ONLINE WEB PORTAL

Union Minister of State for

Personnel, Public Grievances & Pensions and Prime Minister’s Office Shri V

Narayanasamy has said that rtionline web portal is another milestone in the

regime of RTI that will further promote participation of our citizens in the

process of governance and policy making decisions of the Government.Speaking at

the launch of the portal in New Delhi today he said though presently this

facility has been provided to Central Ministries, DoPT will consider extending

this facility to the subordinate and attached offices of Central Government

also. The Minister also appealed to the State Governments to consider

developing similar facility of filing online RTI applications. Referring to the

RTI Act as one of the biggest achievements of our democracy, Shri Narayansamy

said that it has empowered the citizenry in an unprecedented manner to

participate in nation building by promoting transparency and accountability in

the working of every public authority.

The rti online

web portal has been developed by National Informatics Centre (NIC) at the

initiative of Department of Personnel and Training. The url of this portal is

https://rtionline.gov.in.

This is a

facility for the Indian Citizens to file RTI applications online and first

appeals and also to make online payment of RTI fees. The prescribed fees can be

paid through Internet banking of State Bank of India and its associate banks as

well as by Credit/Debit cards of Visa/Master, through the payment gateway of

SBI linked to this site. This facility is available for all the

Ministries/Departments of Govt. of India.

This system

provides for online reply of RTI applications/ first appeals, though reply

could be sent by regular post also. This system works as RTI MIS also. The

details of RTI applications received through post could also be entered into

this system. The citizens can also check the real time status of their RTI

applications/first appeals filed online.

KSD/Samir/HR (Release

ID :98485) PIB 21.08.2013

MODEL RRS FOR THE POSTS OF ADMINISTRATIVE OFFICER (GROUP A &

B). CLICK HERE FOR DETAILS

LGO EXAMINATION FOR THE

YEAR 2013 WILL BE HELD ON 15TH SEPTEMBER 2013. CLICK HERE FOR DETAILS

CONDUCTING OF LIMITED DEPARTMENTAL COMPETITIVE EXAMINATION FOR

PROMOTION OF TO THE CADRE OF INSPECTOR POSTS (66.66%) DEPARTMENTAL QUOTA FOR

THE YEAR 2013- REVISION IN THE EXAMINATION SCHEDULE CLICK HERE FOR DETAILS

Wednesday, August 21, 2013

Thursday 22 August 2013

CONDUCTING OF LIMITED DEPARTMENTAL COMPETITIVE EXAMINATION FOR PROMOTION OF TO THE CADRE OF INSPECTOR POSTS (66.66%) DEPARTMENTAL QUOTA FOR THE YEAR 2013- REVISION IN THE EXAMINATION SCHEDULE CLICK HERE FOR DETAILS

REVISED ESTABLISHMENT NORMS FOR OPERATIONAL ACTIVITIES AT SPEED

POST SORTING HUBS. INTRA-CIRCLE HUBS AND COMPUTERIZED REGISTRATION.

No. 28-8/2011-D

Government of India

Ministry of Communications & IT

Department of Posts

(Mails Division)

Dak Bhawan, Sansad Marg

New Delhi-110001

Dated 13.08.2013

Sub: Revised Establishment Norms for Operational Activities at

Speed Post Sorting Hubs. Intra-Circle Hubs and Computerized Registration.

Attention is invited to the

Directorate O.M. of even no. dated 17.01.2013 vide which revised norms for

operational activities at Speed Post Sorting Hubs, IC Hubs and CRCs was

circulated.

2. Reference were received as to whether

the revised norms of sorting circulated vide O.M. referred to above were to be considered as productivity

norms or establishment norms . It is clarified that the establishment norms for

operational activities the than that for “Sorting of Articles” would be the

same as circulated vide Directorate OM

of even no dated 17.01.2013. Establishment norms for “Sorting of Articles” has

been fixed as 0.079 minutes per article i.e 760 articles per hour). However,

time factor for productivity pertaining to sorting of articles would continue

to be o.063per article( i.e 950 articles per hour)

3. This issues with the concurrence of integrated

Finance Wing vide their Diary No. 113/FA/13/CS dated 12.08.2013.

REVISED ESTABLISHMENT NORMS FOR SORTING OF ARTICLES AT RMS OFFICES CLICK HERE FOR DETAILS

Tuesday, August 20, 2013

Monday, August 19, 2013

Sunday, August 18, 2013

Saturday, August 17, 2013

better late, than

never!!

at last department of posts and

ministry of communications admitted that

mckensey

model (mnop) l1, l2

model (mnop) l1, l2

is a total failure

orders issued to restore the old

position

name remains (l1, L2) but the scheme stands scraped

the stand taken by the jca (nfpe

& fnpo)

from the very beginning has been

proved right.

it is a victory for our

continuous campaign and struggles including the decision for indefinite strike

which compelled the department to give an assurance that no rms offices will be

closed.

nfpe congratulates the entire

postal and rms

employees for this victory.

Now the question

to be answered by the authorities are:

1. Who is responsible for the delay caused to the

public mails due to back-routing for the last two years?

2. Who is responsible for the loss of public

faith and trust in the Postal department due to heavy delay caused due to L1,

L2 in processing and transmission of public mails?

3. Who is responsible for paying an amount of

more than 100 crores to be Mckensey Consultancy for this anti-people,

anti-worker, “Tuglak Model” reforms?

4. Who are those behind this shady deal with

the Mckensy consultancy? Why are they

not taken to task?

M. Krishnan

Thursday, August 15, 2013

आज़ादी की चाह..?

गरीबी, भुखमरी, बेकारी अब आज़ादी को तड़पती हैं.

महगाई और बेरोजगारी सरकारी नीतियों से बढ़ती हैं.!

भ्रस्टाचार,और शोषण से समाज को क्या मिलेगी मुक्ति ..?

अरे कुछ तो सोचो,कुछ तो करो कुछ तो होगी युक्ति...!

कुपोषण,बाल श्रम और किशानो का आत्म घात..!

कुंठित युवा,ज्ञान का पलायन, इनसे,भी दिलाओ निजात....!

सीमओं पर बढ़ता अतिक्रमण,तेल पर हटता नियंत्रण....?

आज़ादी की चाह में ये,घटनाओ को देते हैं आमंत्रण..?

हर क्षेत्र में माफियो की बढ़ती जमात ,बिगड़ते हालात...!

'संतोष" धधकते सवालो से मुक्ति, आज़ादी की सौगात...?

केंद्रीय कर्मचारियों और पेंशनरों के लिए राहत वाली खबर है।

रिटायरमेंट से छह माह पहले सेवानिवृत्ति लाभों से संबंधित तमाम प्रकार के फॉर्म भरने में उन्हें माथापच्ची नहीं करनी होगी और न ही फॉर्म में किसी ऐसी गड़बड़ी की गुंजाइश होगी कि रिटायर के बाद उसकी वजह से दिक्कत का सामना करना पड़े।

केंद्रीय पेंशन एवं पेंशनर्स कल्याण विभाग ने तमाम फॉर्र्मों के सरलीकरण के लिए प्रस्तावित प्रारूप तैयार कर लिया है। साथ ही इस बाबत विभागों और पेंशनरों के संगठनों से भी सुझाव मांगे हैं।

दरअसल, रिटायर होने से पहले केंद्रीय कर्मचारियों को तमाम तरह के फॉर्म भरने पड़ते हैं। फॉर्म भरने की प्रक्रिया काफी जटिल है। रिटायरमेंट के बाद मौत हुई तो पेंशन का भुगतान किसे होगा?

पहले आश्रित की भी मौत हो गई तो उसके बाद पेंशन किसे मिलेगी? आश्रित की उम्र क्या है? ऐसे ही तमाम सवालों के जवाब फॉर्म में दर्ज करने होते हैं।

फॉर्म का प्रारूप जटिल होने के कारण अक्सर उसमें गलतियां हो जाती हैं और रिटायरमेंट के बादर पेंशनर या उसके आश्रित को दिक्कत का सामना करना पड़ता है।

इन्हीं समस्याओं से निपटने के लिए केंद्रीय पेंशन एवं पेंशनर्स कल्याण विभाग ने फॉर्म का आसान प्रारूप तैयार किया है, जो विभाग की वेबसाइट पर भी डाउनलोड कर दिया गया है।

साथ ही संबंधित विभागों और, पेंशनरों और उनके संगठनों से भी सुझाव मांगे गए हैं ताकि प्रस्तावित प्रारूप में संशोधन करते हुए उसे और अधिक सरलीकृत किया जा सके।

सिविल एकाउंट ब्रदरहुड के पूर्व अध्यक्ष हरिशंकर तिवारी का कहना है कि फार्म का सरलीकरण हो जाने से गलती की गुंजाइश कम हो जाएगी।

रिटायरमेंट से छह माह पहले सेवानिवृत्ति लाभों से संबंधित तमाम प्रकार के फॉर्म भरने में उन्हें माथापच्ची नहीं करनी होगी और न ही फॉर्म में किसी ऐसी गड़बड़ी की गुंजाइश होगी कि रिटायर के बाद उसकी वजह से दिक्कत का सामना करना पड़े।

केंद्रीय पेंशन एवं पेंशनर्स कल्याण विभाग ने तमाम फॉर्र्मों के सरलीकरण के लिए प्रस्तावित प्रारूप तैयार कर लिया है। साथ ही इस बाबत विभागों और पेंशनरों के संगठनों से भी सुझाव मांगे हैं।

दरअसल, रिटायर होने से पहले केंद्रीय कर्मचारियों को तमाम तरह के फॉर्म भरने पड़ते हैं। फॉर्म भरने की प्रक्रिया काफी जटिल है। रिटायरमेंट के बाद मौत हुई तो पेंशन का भुगतान किसे होगा?

पहले आश्रित की भी मौत हो गई तो उसके बाद पेंशन किसे मिलेगी? आश्रित की उम्र क्या है? ऐसे ही तमाम सवालों के जवाब फॉर्म में दर्ज करने होते हैं।

फॉर्म का प्रारूप जटिल होने के कारण अक्सर उसमें गलतियां हो जाती हैं और रिटायरमेंट के बादर पेंशनर या उसके आश्रित को दिक्कत का सामना करना पड़ता है।

इन्हीं समस्याओं से निपटने के लिए केंद्रीय पेंशन एवं पेंशनर्स कल्याण विभाग ने फॉर्म का आसान प्रारूप तैयार किया है, जो विभाग की वेबसाइट पर भी डाउनलोड कर दिया गया है।

साथ ही संबंधित विभागों और, पेंशनरों और उनके संगठनों से भी सुझाव मांगे गए हैं ताकि प्रस्तावित प्रारूप में संशोधन करते हुए उसे और अधिक सरलीकृत किया जा सके।

सिविल एकाउंट ब्रदरहुड के पूर्व अध्यक्ष हरिशंकर तिवारी का कहना है कि फार्म का सरलीकरण हो जाने से गलती की गुंजाइश कम हो जाएगी।

Tuesday, August 13, 2013

Finance ministry asks India Post to reroute bank proposal.

New Delhi: The expenditure department of the finance ministry has sent back India Post’s draft cabinet note seeking Rs.1,900 crore to set up a commercial bank to another wing of the ministry and asked it to first seek the approval of the expenditure finance committee (EFC). The entity is proposed to be named Post Bank of India.

The postal department is among 26 applicants that sought banking licences from the Reserve Bank of India (RBI) on 1 July, part of the government’s initiative to expand the Rs.77 trillion banking industry and widen access to financial services among the 40% of the population that are yet not included in the system.

“Since the proposal has financial consequences, we have told India Post to first approach the expenditure finance committee with their proposal before going for an inter-ministerial consultation on the matter,” said a finance ministry official who didn’t want to be named.

A second finance ministry official confirmed this. He said the expenditure finance committee was yet to receive the note from the postal department. He said, however, that the committee was likely to clear the proposal once it’s received.

“We cannot pre-empt how much money EFC will approve, however I am sure the proposal makes sense because they have such a vast network which they should utilize. The only thing is they have to develop the standards to meet the RBI guidelines,” he added.

Approval of the expenditure finance committee, headed by the expenditure secretary, is required for proposals involving spending of more than Rs.300 crore and the setting up of new autonomous organizations, regardless of the amount.

The postal department, faced with the dwindling of its main business as more people switch to electronic means of communication and courier companies, wants to leverage its extensive reach across India by entering the banking business. It’s currently involved in the financial industry to the extent that it runs post-office savings schemes, besides collecting deposits for tax-free savings programmes.

In its guidelines for new banking licences announced on 22 February, RBI required applicants to prove their eligibility on several fronts—from promoter holding to past experience to business plans. The minimum capital required by applicants for licences is Rs.500 crore, and foreign shareholding in the new banks is capped at 49% for the first five years.

The new banks have to be set up under a non-operative financial holding company (NOFHC), RBI said. They also have to maintain a minimum capital adequacy ratio—the ratio of capital to risk-weighted assets, a measure of financial strength—of 13% for the first three years. New banks also need to list their shares within three years of starting operations.

The finance ministry has been reluctant to allow India Post to enter the commercial banking business.

In order to apply for a licence, the department of posts will have to create a legal entity to segregate its banking and postal businesses, said a second finance ministry official.

“It will have to be a government-owned company or a bank under a statute since a government department cannot become a bank,” said the official, who didn’t want to be identified.

“Added to that, the postal department has no experience when it comes to giving credit. They have only been taking deposits till now. Sanctioning and disbursing credit needs an entirely different aptitude,” the official said. “We had conveyed our views to EY, when they had approached us on this issue,” he added. EY (formerly Ernst & Young) is consultant to India Post’s bid for a banking licence.

A third finance ministry official said it will be difficult for India Post to get a banking licence from RBI since the guidelines call for a non-operative financial holding company.

Besides that, although India Post boasts of a strong 150,000 branch network, a majority of these may not get converted into bank branches in the event it gets a licence, this official added.

“Expertise in (handling) National Savings Certificates will not be enough for giving credit,” he added, making the point that the department has no specialized experience in the business.

India Post had 154,822 branches across the country as of 31 March, the latest data available, the largest for any postal department in the world, and close to 90% of them—139,086—are in rural India. This is more than four times the number of rural branches run by India’s banks.

RBI has clarified that the conditions it has set are merely the necessary ones and that all applicants meeting them won’t be given a licence. The central bank will screen the applications, refer them to an advisory committee and take a final call on licences based on its recommendations.

If the focus is financial inclusion, the focus should be on looking for solutions rather than raising barriers, said Ashvin Parekh, national leader, global financial services at EY.

“Nobody is saying to convert the existing Post Office Savings Bank (POSB) into a commercial bank. Post Bank of India has to be a subsidiary which needs to be registered as a company and the government equity in this new entity could be diluted,” he said. Through the POSB, India Post collects deposits starting as low as Rs.20 with an annual interest rate of 4%.

Naina Lal Kidwai, country head of HSBC India and president of the Federation of Indian Chambers of Commerce and Industry lobby group, said in an interview that though she is opposed to creating any more public sector banks, she supports the idea of the Post Bank of India.

“The postal authority is a very interesting one because of its ability to deliver cash where banks have never been able to reach. To create a post bank, which many countries have done, is quite interesting. So for those exceptions, we could and should look at giving (it a) banking licence,” she added.

However, Kidwai wants the government to reduce its share in the banking system from 70% now to 30-50%, besides which she’d like to see consolidation of the sector.

“We have to fund such banks through taxpayers’ money. These banks can rarely raise money from the capital market. Some of those can actually be merged so that we create fewer banks. So we should see a restructuring of our entire banking sector,” she added.

New Delhi: The expenditure department of the finance ministry has sent back India Post’s draft cabinet note seeking Rs.1,900 crore to set up a commercial bank to another wing of the ministry and asked it to first seek the approval of the expenditure finance committee (EFC). The entity is proposed to be named Post Bank of India.

The postal department is among 26 applicants that sought banking licences from the Reserve Bank of India (RBI) on 1 July, part of the government’s initiative to expand the Rs.77 trillion banking industry and widen access to financial services among the 40% of the population that are yet not included in the system.

“Since the proposal has financial consequences, we have told India Post to first approach the expenditure finance committee with their proposal before going for an inter-ministerial consultation on the matter,” said a finance ministry official who didn’t want to be named.

A second finance ministry official confirmed this. He said the expenditure finance committee was yet to receive the note from the postal department. He said, however, that the committee was likely to clear the proposal once it’s received.

“We cannot pre-empt how much money EFC will approve, however I am sure the proposal makes sense because they have such a vast network which they should utilize. The only thing is they have to develop the standards to meet the RBI guidelines,” he added.

Approval of the expenditure finance committee, headed by the expenditure secretary, is required for proposals involving spending of more than Rs.300 crore and the setting up of new autonomous organizations, regardless of the amount.

The postal department, faced with the dwindling of its main business as more people switch to electronic means of communication and courier companies, wants to leverage its extensive reach across India by entering the banking business. It’s currently involved in the financial industry to the extent that it runs post-office savings schemes, besides collecting deposits for tax-free savings programmes.

In its guidelines for new banking licences announced on 22 February, RBI required applicants to prove their eligibility on several fronts—from promoter holding to past experience to business plans. The minimum capital required by applicants for licences is Rs.500 crore, and foreign shareholding in the new banks is capped at 49% for the first five years.

The new banks have to be set up under a non-operative financial holding company (NOFHC), RBI said. They also have to maintain a minimum capital adequacy ratio—the ratio of capital to risk-weighted assets, a measure of financial strength—of 13% for the first three years. New banks also need to list their shares within three years of starting operations.

The finance ministry has been reluctant to allow India Post to enter the commercial banking business.

In order to apply for a licence, the department of posts will have to create a legal entity to segregate its banking and postal businesses, said a second finance ministry official.

“It will have to be a government-owned company or a bank under a statute since a government department cannot become a bank,” said the official, who didn’t want to be identified.

“Added to that, the postal department has no experience when it comes to giving credit. They have only been taking deposits till now. Sanctioning and disbursing credit needs an entirely different aptitude,” the official said. “We had conveyed our views to EY, when they had approached us on this issue,” he added. EY (formerly Ernst & Young) is consultant to India Post’s bid for a banking licence.

A third finance ministry official said it will be difficult for India Post to get a banking licence from RBI since the guidelines call for a non-operative financial holding company.

Besides that, although India Post boasts of a strong 150,000 branch network, a majority of these may not get converted into bank branches in the event it gets a licence, this official added.

“Expertise in (handling) National Savings Certificates will not be enough for giving credit,” he added, making the point that the department has no specialized experience in the business.

India Post had 154,822 branches across the country as of 31 March, the latest data available, the largest for any postal department in the world, and close to 90% of them—139,086—are in rural India. This is more than four times the number of rural branches run by India’s banks.

RBI has clarified that the conditions it has set are merely the necessary ones and that all applicants meeting them won’t be given a licence. The central bank will screen the applications, refer them to an advisory committee and take a final call on licences based on its recommendations.

If the focus is financial inclusion, the focus should be on looking for solutions rather than raising barriers, said Ashvin Parekh, national leader, global financial services at EY.

“Nobody is saying to convert the existing Post Office Savings Bank (POSB) into a commercial bank. Post Bank of India has to be a subsidiary which needs to be registered as a company and the government equity in this new entity could be diluted,” he said. Through the POSB, India Post collects deposits starting as low as Rs.20 with an annual interest rate of 4%.

Naina Lal Kidwai, country head of HSBC India and president of the Federation of Indian Chambers of Commerce and Industry lobby group, said in an interview that though she is opposed to creating any more public sector banks, she supports the idea of the Post Bank of India.

“The postal authority is a very interesting one because of its ability to deliver cash where banks have never been able to reach. To create a post bank, which many countries have done, is quite interesting. So for those exceptions, we could and should look at giving (it a) banking licence,” she added.

However, Kidwai wants the government to reduce its share in the banking system from 70% now to 30-50%, besides which she’d like to see consolidation of the sector.

“We have to fund such banks through taxpayers’ money. These banks can rarely raise money from the capital market. Some of those can actually be merged so that we create fewer banks. So we should see a restructuring of our entire banking sector,” she added.

Simplification of Procedure for Payment of Family Pension

Wednesday 14 August 2013

GRANT OF TRANSPORT

ALLOWANCE TO ORTHOPAEDICALLY HANDICAPPED CENTRAL GOVERNMENT EMPLOYEES CLICK HERE FOR

DETAILS

SUPPLY OF CTS-2010 STANDARD CHEQUE BOOKS TO POSB CUSTOMERS CLICK HERE FOR DETAILS

Monday, August 12, 2013

RETIREMENT AGE 62

Central Government Employees are eagerly waiting for

increase in the age of superannuation from 60 to 62 years. Media News

says that there is likelihood of an announcement by the Prime Minister

of India during his speech to the Nation on the eve of Independence Day

i.e. on 15 August 2013.

Sunday, August 11, 2013

GDS BONUS CEILING – LATEST POSITION

Secretary, Department of Posts

held discussion with Secretary Generals of NFPE and FNPO and all the General Secretaries

of affiliated Unions/Associations on 02.08.2013 at Dak Bhawan, New Delhi. GDS

Bonus case was discussed in detail. Secretary, Department of Posts, informed

that Postal Board has again sent the file for approval of the Finance Ministry

after replying all the queries raised by Finance Ministry. On behalf of AIPEU,

GDS (NFPE) Com. P. Pandurangarao, General Secretary attended the meeting.

Minutes of the meeting will be published later.

(M. Krishnan)

Secretary General Friday, August 9, 2013

Saturday 10 August 2013

HOLIDAYS TO BE OBSERVED IN CENTRAL GOVERNMENT OFFICES DURING THE

YEAR 2014 (CLICK LINK BELOW

FOR DETAILS)DETAILS) http://www.indiapost.gov.in/DOP/Pdf/Circulars/21_1_2013-PEII12july2013.PDF

Thursday, August 8, 2013

Wednesday, August 7, 2013

Thursday, August 08, 2013

Employees’ Pension Scheme : Pension to Retired Employees Covered Under PF Scheme

PFRDA BILL

LISTED IN THE AGENDA OF THE CURRENT SESSION OF THE PARLIAMENT

CONFEDERATION CALLS UPON THE CENTRAL GOVERNMENT

EMPLOYEES TO ORGANIZE TWO HOURS WALK-OUT PROGRAMME ON THE DAY WHEN THE BILL IS

TAKEN UP FOR DISCUSSION

IN PARLIAMENT

As you are aware, Central

Government is going ahead with their agenda on pension privatization. The

controversial PFRDA Bill (Pension Fund Regulatory and Development Authority

Bill) is listed as an agenda item for the current Parliament session. The bill

may be taken up for discussion in Parliament on any day. Confederation of

Central Government Employees & Workers has opposed the Contributory Pension

Scheme and also the PFRDA Bill from the very beginning.

We have conducted so many

agitational programmes including strike. The left parties in the parliament

have also strongly opposed the Bill. Inspite of the opposition from employees

(both Central Government and State Government Employees & Teachers) and

also from left political parties, the Central Government is not ready to

withdraw the contributory Pension scheme or to scrap the PFRDA Bill.

The National Secretariat of the

Confederation has viewed the move of the Government with grave concern and

decided to call upon the entirety of the Central Government Employees &

Workers to organize mass protest demonstration in front of all offices throughout

the country after walking out from

offices for two hours, on the day when the bill is taken up for discussion

in Parliament or on the next day if information is received late.

All India office bearers, State

level COCs and other COCs are requested to make the two hours walk out

programme a grand success.

(M. Krishnan)

Secretary General

Confederation

Press Information Bureau

Government of India

Ministry of Labour & Employment

07-August-2013

GoM on Workers' Demands

Government has set up a Group of four Ministers led by Shri A.K. Antony to discuss the workers' demands with the United front of trade unions.

Two meetings of the Group of Ministers (GoM) were held on 18.02.2013 and 22.05.2013 in which the ten point Charter of

Demand of the trade unions were discussed. The discussions remained

inconclusive and it was decided that the issues/demands will be

considered by the Group of Ministers themselves before further

discussions with the Central Trade Unions representatives. As such, no

final recommendation has been given by the GoM.

This

information was given by Minister of State for Labour & Employment

Shri Kodikunnil Suresh in the Lok Sabha today in reply to a written

question.

PIB

Soon, post offices to be like banks

Sony BRAVIA 4K TV - Experience Perfection With 4k Picture, Sound & Monolithic Design.www.sony.co.in/Bravia_4k_TV

The HinduThe Anna Road head post office is one of four in the city that have been selected for the project — File Phot

Under new project, select head post offices will have ATMs, offer internet and mobile banking

Postal customers may soon be able to access their savings bank account in any post office in the city.

The department of posts is putting in place core banking solutions (CBS)

at four of its head post offices in Chennai, and the process is

expected to be completed by September. This means these post offices

will become like banks and offer a range of services.

The head post offices on Anna Road and in T. Nagar, Mylapore and

Tambaram will soon be networked via CBS, which is one of the postal

department’s flagship projects.'

At present, customers who have postal savings accounts have to go to the

post office where their account is, to carry out any transaction. They

also have to wait in long queues to withdraw cash or to get their

monthly pensions.

But once CBS is implemented, customers can go to any post office covered

under the system and carry out transactions. The project also envisages

installing ATMs at these four post offices by October, so that their

2.5 lakh account-holders will be able to access their accounts at the

swipe of a card.Customers who have invested in savings

certificates too, can encash them using CBS.

Officials of the postal department said they had tied up with Infosys to

eventually implement CBS in 110 post offices across the city and its

suburbs. Currently, software testing for the project is in progress.

Welcoming the move, 70-year-old D. Sriraman, a resident of Villivakkam,

said this would benefit several people who now spend at least half an

hour just to withdraw cash.

The CBS project will be rolled out in all post offices over the next two

years in a phased manner. Services offered will include internet

banking, mobile banking and mobile transfer of money. The department

also is mulling over a proposal to integrate other postal services with

CBS.

Postmaster general, Chennai city region, Mervin Alexander said there are

nearly 3.3 crore savings account-holders in the region. All postal

employees are now being given extensive training in CBS, he added.

Keywords: post offices, savings bank accounts at post offices

Subscribe to:

Comments (Atom)